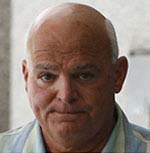

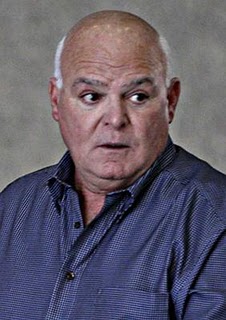

The Teachers’ Retirement System is broke and it is largely the fault of the state government, at least according to TRS Executive Director Dick Ingram. According to new numbers making the rounds throughout Illinois, the Teachers’ Retirement System may be insolvent as soon as 2030 because the state legislature has repeatedly delayed or flat out refused to supply promised funding. The TRS currently has 81 billion dollars in long-term liability, with the long-term unfunded liability of 44 billion dollars.

But to hear the governor and state legislature talk about it, you might think this funding nightmare is not the fault of anyone. House Speaker Michael Madigan, who has been in the state legislature since 1971 and has been Speaker for over 25 years, certainly is not to blame. “We’ve got huge budget problems in this state. Why? Well, there was overspending in the past and many people engaged in the overspending. It wasn’t just one or two people,” the Speaker recently opined at a rare press conference.

So the state has obligated itself to unions and is required by law to put money into the pension system, but that is unimportant. Decades of Democrat cronyism has resulted in promises the government could not keep, but that is unimportant too. What’s important now is that the state does not want to pay out of the substantial revenue streams they already have – they want us to pay more instead.

Speaker Madigan thinks that the state should be allowed to ignore the repercussions of Springfield’s Machine-style business practices and instead pass the gargantuan debt of unfunded teacher pensions back to the school districts and teachers. At a recent forum run by the Chicago Tribune, Governor Quinn was quick to impugn anyone besides the Democrats for Illinois’ pension fiasco, despite the fact that the party has controlled all the branches of state government since 2002. The governor was particularly keen on shifting the blame for shortfalls to the schools themselves, saying “they should have a stake in the retirement of their own employees.” Governor Quinn seems to be forgetting that teachers and school districts already contribute to the pension program. The teachers, who pay in a little over 9%, have met their obligation for decades.

3 Comments

Good story Joe, the fact remains we have too many over paid retirees who benefitted from poor laws and rules. The rules allowed salaries to jump near retirement age so they got more when they retired. This loop hole is effects many public union employees. When you hear people say they make more money retired than when they worked somthing is definitely WRONG with the system.

http://www.championnews.net/2011/04/05/82981-of-132502-illinois-teachers-pay-nothing-or-little-into-their-pensions/

The pensions have already caused some cities to declare bankruptcy and to forgo paying the pensions. Those retirees have been forced to go back to work, move in with other family members, or end up homeless.

While cities and counties can declare bankruptcy, states cannot. So what does a state do? Raise taxes. What about a state like California where state taxes have to get voter approval? If the voters say no, then the state will have to go to court and the unions may try to get the court to impose an increase it state taxes. In the meantime, the state’s debt will continue to increase and people won’t want to buy bonds to loan the state money. Unlike the feds, states cannot print their own money (which decreases the value of the dollar and causes inflation). The state will be forced to make massive layoffs, increasing unemployment. The states like California in this or similar situations will experience its own “Great Depression.” Illinois and New York are among those states in similar situations. We’ll see what happens, but the future doesn’t look good. In the end, trust in the Lord for your hope, man and governments fail.